What is the minimum wage in Australia?

Australia has one of the highest minimum wages in the world. Also in 2020 the minimum wage will be increased step by step for the different industries, starting from July 2020. The minimum wage applies to every employer in Australia and is the absolute minimum you must be legally paid per hour. As a casual employee you even get a 25% bonus. Find out more about the minimum wage, which industries are raising their minimum wage and when, and what the previous minimum wages were in Australia. We'll answer all your questions about the minimum wage in Australia. Have fun making money and enjoying your Work and Travel stay in Australia!

What is the minimum wage in Australia from 2020

The minimum wage for Australia from 2020 is 19.84 AUD. For 2020 the minimum wage in Australia will change on different dates depending on the industry, so be sure to check which award you belong to or whether you are on the national minimum wage. The minimum wage in Australia determines the amount of your hourly wage before tax.

Each year the minimum wage in Australia is set by the Fair Work government authority and has been rising steadily in recent years since 2007.

▷ Here you can find the current minimum wage in Australia.

.

Minimum wage for full-time and part-time employees

The minimum wage as a full-time or part-time employee will be at least 19.84 AUD from 1 July 2020. The minimum wage applies to you if you are employed on a permanent basis for a certain number of hours under an employment contract. If you work flexible on call and for different numbers of hours each day or week, then look in the next line for the minimum wage as a casual employee.

Minimum wage for casual employees

As a casual employee you work on demand and spontaneously, but you do not have a guaranteed number of hours, so you get a 25% bonus.

As a casual, your minimum wage in Australia from 2020 is therefore at least 24.80 AUD per hour.

You are considered casual as soon as you do not have fixed and guaranteed working hours per week. This must also be stated in your employment contract. As a casual, your employer can always make you an offer to work, you can then decide whether to accept or decline it.

Minimum wage including accommodation

If your employer provides you with accommodation or meals (or both), the employer can partially offset this against your salary. However, he cannot deduct an unrestricted high amount.

The amount for accommodation and meals is regulated directly in the collective award of your industry and may not differ from these sums. Check your employment contract again if your employer also provides you with accommodation. This is because employers sometimes like to work with higher deductions than those allowed in the industry awards.

▷ Find out in your award how much you earn with provided accommodation.

Increase of the minimum wage in Australia by Industry Award in 2020

For the minimum wage in Australia from 2020, it is the first time that the minimum wage will be raised on different dates depending on the industry. For 2020 the following deadlines for the minimum wage in Australia apply:

From 1 July 2020 increase of the National Minimum Wage for Australia and all employees covered by Group 1 awards

- Employees in health and social services

- Teachers and child carers

- Other essential jobs from group 1 awards

▷ Here you can find all group 1 awards.

From 1 November 2020 Increase for all employees covered by group 2 awards

- Construction

- Production

- All other industries of group 2 awards

▷ Here you can find all group 2 awards.

From 1 February 2021 increase for all employees covered by group 3 awards

- room and board services

- Art and recreational services

- Aviation

- Retail

- Tourism industry

▷ Here you can find all group 3 awards.

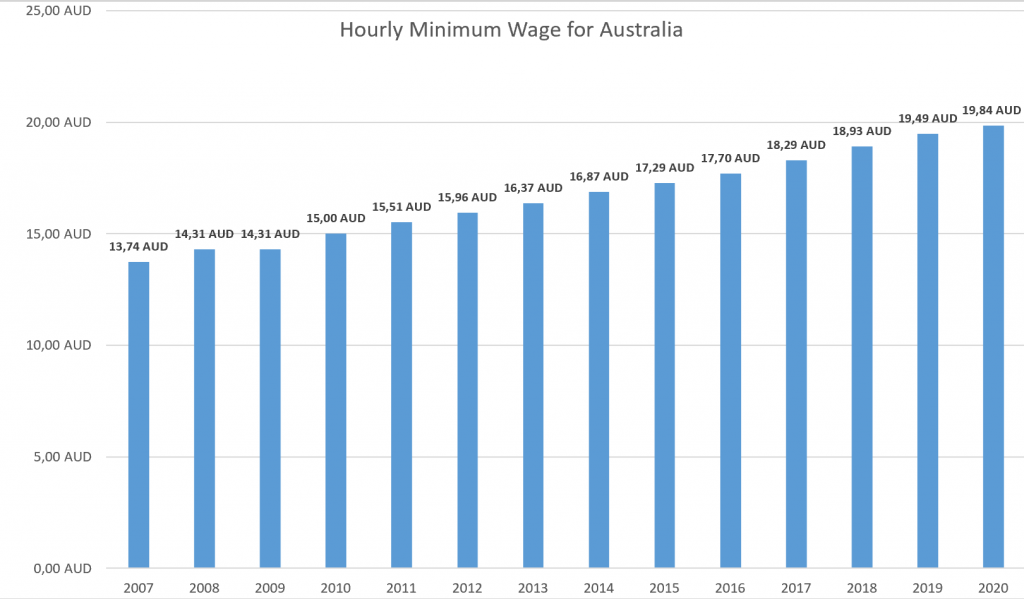

The historical minimum wages in Australia from 2007 to 2020

Here you will find an overview of the national minimum wages in Australia for the past few years. We have put together a nice spreadsheet with the minimum wage for all years from 2007.

Who is eligible to receive the minimum wage in Australia

The minimum wage in Australia applies to every employee worker and for all industries.

There are some industries that have their own collective agreement, which even sets a higher minimum wage. These so-called awards can easily be found on the Fair Work website.

▷ Here you can find all awrds for Australia.

Exception of the minimum wage for self-employed persons:

If you are self-employed in Australia working on your own ABN, the minimum wage does not apply to you. However, you should only work as a self-employed person if you earn more than the minimum wage. As a self-employed person, you are responsible for paying taxes and other charges by yourself.

As an employee you work on your TFN (Tax File Number) and your employer is responsible for paying your tax and super annuation.

As a self-employed person you work on your ABN (Australia Business Number) and are responsible for paying your taxes, insurance and all other costs. Keep this in mind when you work as a self-employed person, as you pay at least 15% at the end of the tax year for your tax portion of your income alone. For higher sums it can also be more tax, see the list of tax rates below.

Who sets the minimum wage in Australia

The minimum wage is set by the Australian Fair Work Authority. Once a year, a decision is made here on the adjustment of the minimum wage. In addition, each trade union can decide on the corresponding collective agreement (award) adjustments for all occupations covered by the award.

Frequently asked questions about the minimum wage in Australia for 2020

Does the minimum wage already include the Super Annuation payment in Australia:

No, in addition to your salary, your employer must pay you the super allowance of 9.5% to a super provider of your choice. There is no super paid for overtime (check your work contract for details).

What is the Super Annuation in Australia:

If you work in Australia, your employer must pay you a pension supplement. This contribution to your pension is called Super Annuation.

So that you do not have to spend your pension beforehand, there are the so-called super providers. These are pension insurance providers to which your employer pays your pension premium directly.

Important to know, your employer must pay this premium if they employ you as an employee, even though you will probably not use your pension in Australia.

Is the minimum wage different for each state in Australia:

No, the national minimum wage is the same throughout Australia. However, each state or union could set different (only higher) minimum wages. If there is a collective agreement for your industry, it's worth looking into it to check your salary level.

▷ Here you can find the current minimum wage for the different awards and states.

Who is not paid minimum wage in Australia:

There is no minimum wage for student internships, voluntary work and all employment relationships on a voluntary basis.

If there is an employment contract that regulates your duties, you are automatically in an employment relationship and are entitled to the Australian minimum wage.

You are also automatically in an employment relationship if your employer charges customers for your work.

How much is the minimum wage in Australia in 2020 in British Pound Sterling:

The Australian minimum wage of 19.84 AUD corresponds to approximately 10.79 GBP (as of August 21, 2020).

From when does the minimum wage in Australia apply for 2020:

The national minimum wage in Australia for 2020 applies from 1 July 2020.

Note that jobs covered by the awards get their increase on different dates. You can find details about the awards and dates in the article above.

What can I do when I'm not being paid minimum wage:

If you are not paid your minimum wage, you can make a complaint about your employer. You can do this free of charge via the Fair Work website.

▷Here you can visit the complaint page of Fair Work.

How much tax do you pay in Australia:

The tax rates in Australia for Working Holiday Makers (Work and Traveller) are graduated as follows You'll be placed in one of four groups depending on your annual income.

Working holiday tax rates for 2020 – 2021

- From 0 – 37.000 AUD -> 15c per 1$ income.

- From 37.001 – 90.000 AUD -> 5.550 AUD plus 32,5c for each additional dollar over 37.000 AUD.

- From 90.001 – 180.000 AUD -> 22.775 AUD plus 37c for each additional dollar over 90.000 AUD.

- From 180.001 and more -> 56.075 AUD plus 45c for each additional dollar over 180.000 AUD.

▷ The most common questions about tax in Australia.

You might be interested in this as well:

- Working Holiday Guide to Australia

- The best apps for your Australia journey

- Covid-19 Information & News for Australia

Ciao Julian 🙂

Follow Me on YouTube, Facebook, and Instagram.

If you find this helpful: Share It with your friends!